The End of Carried Interest in Private Equity

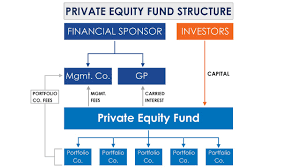

Carry is the percentage of investment profits retained by private equity fund managers as compensation above and beyond their management

fees, usually estimated to average approximately 20% of fund profits. Carry is determined by fund performance; one factor which draws investors to invest in them.

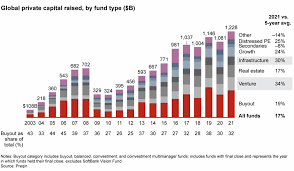

Carried interest is highly prized within the $4.5 trillion US industry, so its tax code offers special consideration for it when held for over three years – it can then be classified as long-term capital gains rather than ordinary income and taxed at up to 37%, whereas ordinary income may be taxed at as much as 40% or 37% respectively. Furthermore, carried-interest gains are exempted from federal Social Security and Medicare taxes altogether – creating a loophole which critics argue allows private-equity/ venture-capital fund managers to avoid fully paying taxes on earnings earned.

As private-equity professionals are subject to greater taxation, pressure has grown on them to find alternative forms of incentive pay that still align compensation with investor interests – such as equity-based carry, which gives General Partners a share of profits proportionate to their initial capital contribution to a fund.

Although not as lucrative, this approach provides a clearer link between general partner compensation and fund returns without having to hold assets in escrow and negotiate claw-back provisions. Furthermore, investors may find this model simpler to understand and implement – something which is especially essential in an industry which relies heavily on repeat business.

Alternately, private equity managers could shift the focus from carried interest to the actual money in private equity: returns when investments exit. But this will likely prove more challenging and could slow growth rates of this sector as investors become warier of making new investments, according to Gail McManus in her article for Heidrick & Struggles.

Experts speculate that high-carry private equity is coming to an end. UK-based recruitment firm KKR recently issued a report suggesting that senior personnel will no longer choose PE jobs that offer high carries; instead they will prefer positions that offer them something “more.” For more Morning Coffee join our Premium membership here.