Resilience in Private Capital

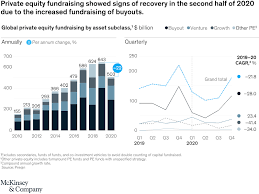

Private capital has shown great resilience despite global instability. There have been positive effects, such as more family offices opening,

increased allocations from institutional investors, and companies opting to remain privately held longer. Furthermore, “dry powder” investment capital available (excluding private credit) now stands at over $3.2 trillion, more than double what was available back in 2011.

Private-market fundamentals provide some insurance against rising interest rates, with floating rate loans often benchmarked to 3-month reference rates being less sensitive to market environments and valuation based on fundamentals rather than mark-to-market valuations than mark-to-market assets prone to seeing interest-rate spreads reversing back towards zero.

Investors should diversify their portfolios with alternative investment strategies, including commingled funds, funds of funds and separately managed accounts – each offering distinct investor needs and goals. Risk weightings and diversification also help mitigate against volatile market conditions.

Redesign of the public-private partnership framework to optimize its potential as a resilience lever is recommended, and can be accomplished by building the appropriate infrastructure to facilitate full range of risk management activities. Leaders can then conduct a comprehensive assessment of the costs and impacts associated with various options, and identify investment opportunities that best suit their organization. Obtaining high-quality data that goes beyond supply chain impact and distribution markets requires more high-quality information that incorporates geopolitical, technological and societal considerations as well as wider framework that reflects global challenges such as climate change, energy transition and customer demand.

Leaders should focus on devising innovative measures that capture value. For instance, they could develop natural capital accounting principles and implement them into valuation assessments in order to measure how investments impact outcomes such as GDP expansion and quality of life.

Leaders must also ensure the resilience pipeline is adequately funded. Funding needs and supply vary significantly across developing nations. To address this discrepancy, leaders can establish legal structures that enable new financing sources and incentives that attract private capital into areas like low-carbon development and climate adaptation, creating a virtuous cycle where resilience themes lead to improved economic performance and GDP growth, offering increased return opportunities for private investments that drive further resilience efforts and funding sources.