private equity investments with Large private equity funds

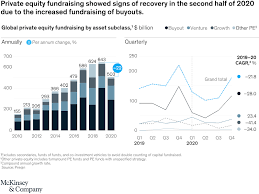

Private equity firms have long been seen as sources of great envy, thanks to their staggering returns generated from aggressive leverage and focus on

cash flow and margins. Their high returns can be attributed to aggressive leverage combined with careful cash management; plus they typically take a hands-on approach when managing operations, being free of regulatory requirements that public companies face. But as tempting as these investment vehicles might appear at first glance, before making your final decision it is essential to carefully consider their possible downsides before investing.

One major issue posed by private equity investments is the disparate impact it has on jobs and growth, creating inequality in wealth distribution. Although often neglected, this topic merits debate because tax reform could promote equitable access to economic opportunities while further contributing positively to both economy and society.

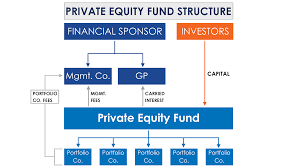

When investing in a private equity fund, rather than owning shares in individual companies you invest in directly, you own shares in the fund itself. Since these private funds don’t need to report quarterly earnings publicly like public companies do and may provide less information than necessary about risk, it may be useful to ask for third-party audited financials from its sponsor.

One issue related to private equity managers’ conflicts of interest lies with their incentive for buying and selling businesses for personal gain rather than the benefit of investors. They may acquire businesses with specific goals in mind such as increasing revenue or cutting costs before seizing on any early opportunities to sell the businesses off at higher prices sooner rather than later.

Large private equity funds face particular risk from operating with too much leverage and having access to too little capital for deployment. One such example was Toys R Us’ demise after Bain Capital and KKR purchased it with debt that continued to spiral relative to revenue growth.

Tax advantages enjoyed by private equity can have serious repercussions. For instance, firms can utilize the Qualified Business Income Deduction, which allows them to deduct interest payments on investments, to reduce their tax bill; this deduction tends to disproportionately benefit high-net-worth individuals and family trusts.

Private equity can be an excellent way to diversify a portfolio, but it may not be suitable for all investors. Before making your decision about whether or not private equity should be included in your strategy, carefully evaluate all its associated risks and benefits with trusted advisors; perhaps finding that it provides the desired balance of risk-return elsewhere might be more advantageous.