Private equity investments differ significantly from stocks

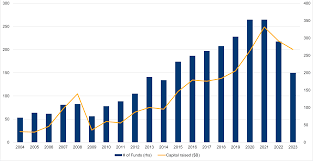

Private equity investment provides an avenue for the purchase of companies or assets without making them public. Investments made via specialized

private equity firms that create funds are made possible, inviting investors to contribute and invest directly. Private equity can include wholesale purchases of privately held companies or assets; mezzanine financing for startup projects; growth capital investments into existing businesses and leveraged buyout of publicly held assets into private control.

Private equity firms add value by buying distressed or underperforming businesses and then restructuring them to improve competitiveness, operations and management. These investments typically take several years before private equity firms sell it off at a profit – earning it the infamous reputation as an unsavory form of profiteering criticized in “Barbarians at the Gate.”

Private-equity investors seek to generate high returns from companies that are struggling to generate profits on their own. Over-leveraged firms may require debt reduction in order to increase operating margins and improve valuation by making operational efficiencies such as cost cutting, supply chain improvements and sales and marketing initiatives more efficient.

Many private-equity firms target niche companies that provide superior customer service or offer products and services not available elsewhere, making them attractive investments when poised for expansion through international sales channels or increased production capacity. Private-equity backers can also assist by adopting more flexible management practices to facilitate innovation or adaption quickly within their portfolio company.

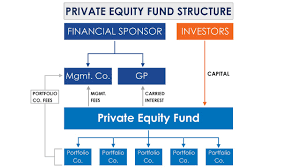

Private-equity funds typically take the form of limited partnerships, with general partners running and selecting investments while limited partners act as investors who put money into the fund. When fundraising goals have been met, the private-equity firm closes down the fund; newcomers cannot invest after closing date unless purchasing shares on secondary market.

Private-equity investments differ significantly from stocks in that they cannot easily be converted to cash, unlike stocks which can easily be traded. Most investments made over five years require funds from limited partners until private-equity firms make sales that can return the initial capital invested back.

Lack of liquidity makes diversifying one’s portfolio with private-equity investments difficult, while its slow path to yielding profits eats away at returns that would have otherwise been achievable with other investments over the same period. Because of these considerations, many Limited Partners (LPs) use private-equity as an investment vehicle to broaden their overall portfolio with other forms of investments.