Private Equity Groups Have Jumped Into the Accounting Sector With Enthusiasm

Private equity groups have made inroads into the accounting industry with gusto, providing cash and expertise to increase service offerings,

revamp staffing models, increase efficiency and create value – creating new firms which some claim are creating a threat to traditional independent accountancies.

As more firms face the perils of Private Equity investment, many accountants worry about its effects on their long-term career prospects.

Goering stresses the importance of remembering that while PE capital can provide substantial advantages, it shouldn’t be seen as a magic bullet. Firms taking on outside investors must be ready to put in the hard work necessary for them to thrive.

When firms are unprepared, private equity deals can do more harm than good. For instance, when taking over accounting practices and cutting staff numbers drastically can leave behind an under-prepared workforce to serve its clients effectively – and therefore erode client satisfaction as well as attract top talent away.

Wurtzbacher noted that CPA firms can successfully attract and manage private equity investment without losing their culture, with due diligence being the cornerstone of creating strong investor relations. She and Goering both stressed the significance of networking with other CPA firms that have taken on PE investments to learn about their experiences.

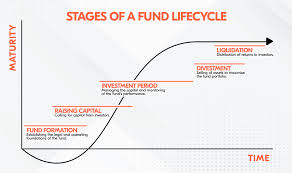

Though private equity comes in various forms, its most basic concept involves purchasing an existing company and improving its performance through acquisitions or restructuring. Once they reach their desired return on investment, private equity firms typically sell off the business at a profit for further gain.

Accounting firms‘ goals would likely include acquiring an established, profitable business with significant growth potential and an experienced management team, then improving operations through technology changes while capitalizing on its reputation to recruit top talent.

Negotiating with limited partners – who provide funding to private equity firms – requires strong presentation and negotiation skills, with extensive travel required to meet potential investees.

Even with its challenges, PE remains resilient. A variety of factors is driving this growth, including limited partners’ desire to meet specific goals through niche specialization such as growth funds, ESG specialists and secondaries.