Private Equity Groups Battle It Out For $15 Billion Schools Group

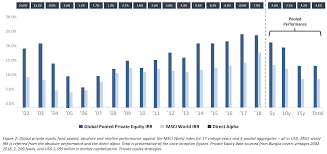

Private equity firms take over companies with the intent of turning them around, usually by cutting costs and speeding growth, before selling it

and collecting their investment returns. Private equity firms don’t face taxes that could limit profits as public firms would, which explains why so many business school graduates who once desired employment at Goldman Sachs now flock towards Blackstone and KKR instead.

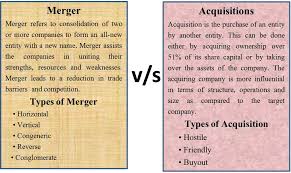

Private-equity groups’ strategies vary by industry, with the primary goal of increasing revenue and profit through acquisition of undervalued businesses. They achieve this by cutting costs, restructuring debt and “multiple arbitrage”, an investment technique where stocks of companies with assets or earnings that surpass their current price are purchased to realize greater returns than otherwise possible.

Private equity firm Audax Group was successful in increasing its returns from New Story Schools, an education network which last year acquired several local special education and behavioral-services schools, by rapidly expanding it more quickly than anticipated. Unfortunately, however, this resulted in staff cuts, reduced services for both students and parents as well as higher fees to cover external investments.

Business Insider reviewed thousands of pages of records and interviewed 20 current or former employees and parents to better understand what had occurred. Many reported concerns that their students’ safety and academic progress had taken a backseat to profit-seeking at times; others filed suits alleging mistreatment. What we discovered is deeply concerning.

At New Story Schools, one of the root causes of its issues lies with its ownership by a private-equity firm which seeks to maximize return from its purchase of New Story schools. According to sources familiar with this matter, this firm has sought a quick sale in order to maximize returns from investment.

Private-equity owned schools across the nation are being overwhelmed by rising employee costs from higher minimum wages, increasing insurance reimbursement rates, and complying with health and safety requirements – creating what one expert calls a “perfect storm.” “All these factors combined make it very hard for organizations to keep pace with expenses.”

Brendan Ballou argues in his book, Plunder: Private Equity’s Plan To Plunder America, that private-equity firms are using large scale operations with few people understanding their tactics to wreak havoc upon healthy companies while exploiting vulnerable consumers like elderly nursing home residents and hospital patients who can no longer defend themselves against private-equity firms’ tactics. But because this process operates on such a grand scale it may prove hard to halt.