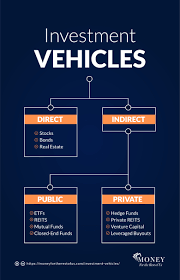

Private equity funds are investment vehicles that pool capital

Private equity funds are investment vehicles that pool capital from third-party investors to acquire and improve companies with the aim of ultimately

selling them on for profit. Private equity firms usually take the form of partnerships, with limited partners (LPs). Investors in these partnerships include institutional or individual pension funds, endowment funds, retirement funds, insurance companies and high net-worth individuals as potential LP investors. They contribute most of the funds that support private equity firms while creating terms in a limited partnership agreement regarding how funds will be managed and paid out.

Private equity funds often employ various strategies, with one of the most prevalent being buying companies to use as leverage to increase returns for all Limited Partners in their fund. This process is known as buyout and can take the form of purchasing either an unlisted public company without an IPO, or by acquiring private companies and then changing them through buyouts to reflect new ownership – often changing names to reflect this fact, among other modifications that may take place as well.

Another key element of any private equity fund is the amount of debt used in purchasing companies. Leverage allows PE firms to reduce the required equity investment amount for deals while speeding up potential returns through dividend recapitalization; when dividend distributions are reinvested back into companies that they own by borrowing money instead.

Additionally to traditional buyouts, some private equity funds specialize in particular industries or regions, or seek secondary investments; others specialize in activist investing or funds of funds.

As private equity deals are not registered with the Securities and Exchange Commission, they don’t need to make as many public disclosures than mutual or index funds; however, this doesn’t mean LPs don’t face similar risks as other investors.

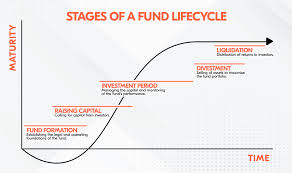

Private equity funds‘ primary risk is their long-term illiquidity; investments cannot be sold easily and tend to have longer investment horizons than most other asset classes. A separate issue concerns the amount of due diligence necessary in evaluating startup companies and making investment decisions accordingly.

Investors in private equity funds often incur management fees and carry interest fees charged by the general partner (GP) of the fund, which can lower overall profits. A common fee structure is known as “two and twenty”, charging investors an annual management fee of 2% with 20% deducted if profits surpass certain hurdle rates; some private equity firms use other compensation structures in order to incentivize GPs by giving them “skin in the game.” This article highlights some key aspects of private equity funds.