Private equity firms usually establish funds as Limited Partnerships

Private equity funds are investment vehicles designed to make investments in privately-owned companies and increase in value over time, ultimately

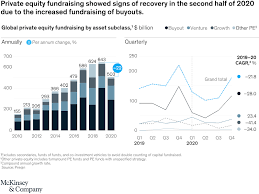

being sold off or taking public through an initial public offering (IPO). Private equity funds often invest in various industries including technology, healthcare and financial services.

Private equity firms make their money primarily through charging management fees and profit shares above a threshold known as the hurdle rate, usually monthly or quarterly. A private equity firm may also be compensated for efforts it undertakes in securing buyout or liquidation of its portfolio companies; as a result, investments made with these types of firms tend to be far less liquid than public market assets; however secondary markets have now begun emerging to offer some liquidity for these types of investments.

Private equity firms tend to specialize in particular areas of the business cycle and may specialize in investing in young, growing companies with potential, more mature firms with reliable cash flows or failing companies that need restructuring. Their investment strategies tend to be more aggressive than those utilized by traditional public market investors and may include innovative financing techniques like leveraged buyouts.

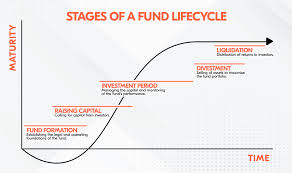

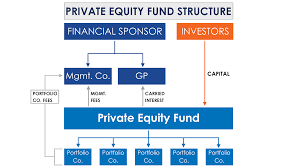

Private equity firms usually establish funds as Limited Partnerships when making new investments and seek other investors to contribute capital as Limited Partners. The General Partner has the responsibility of overseeing this process in order to maximize value creation from each investment and protect all limited partners’ interests.

Once a fund has reached a certain size, it can begin purchasing shares of private companies from existing shareholders or directly from companies seeking to sell. Funds generally hold onto companies for three to five years while their General Partner explores ways to expand or enhance financial performance before harvesting them either through sale, merger, or public offering (IPO).

Investors in private equity funds typically cannot withdraw their original capital until the fund’s lifecycle, typically 10-12 years, ends. Although this has traditionally been seen as deterring some investors from participating, more recently many funds offer secondary market opportunities which provide some liquidity in case of emergencies or poor performance.

When investing in private equity funds, it is crucial to evaluate their management fees, charges, multiple on invested capital metrics, and internal rate of return metrics in relation to other considerations such as risk profile and investment goals. To gain more insight into various investment vehicles available visit LSEG Workspace by choosing Search Tools > Company & Deals or entering PE/VC into the search box.