Private equity firms using a leveraged buyout

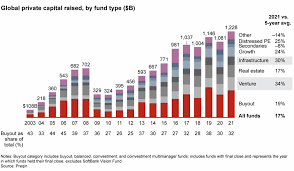

Private equity refers to the investment of funds from wealthy individuals and institutions into businesses not listed on stock exchanges. It

encompasses various investments, from venture capital (VC), which invests in early-stage companies with innovative ideas or technologies but no revenue, to growth equity which provides funds for expansion of privately held businesses. Furthermore, it can include buyout transactions wherein private equity firms take over publicly listed companies through so-called leveraged buyout (LBO).

Private equity firms make money not only through investing but also by charging management fees and taking a cut of proceeds when their portfolio companies are sold off. This compensation structure, known as “two-and-twenty rule,” can quickly add up; Blackstone Group manages more than $10 trillion of assets under management and earns both fixed fees of around 2% of funds managed as well as 20% share of profits generated from portfolio company sales profits.

Private equity fund managers conduct extensive research of both a potential target company and industry before making an investment decision. When making their selection, private equity fund managers look for businesses with unique market or brand positions, consistent profit and cash flow to cover debt payments, and stable business models not affected by disruptive technologies or new regulations – as well as strong management teams capable of leading them through these challenges.

Once a private equity fund invests, they have the power to implement major changes at any company they invest in, including cost cuts or restructuring measures that aim to increase value of the business before selling for a handsome return on their investment. Private equity owners tend to be more aggressive than other investors because they have only limited time available in which to make these changes.

Private equity firms specialize in finding operational efficiencies and synergies within acquisitions they make, which can help companies increase revenue and expand into new markets by employing digital marketing experts or implementing best practices in e-commerce. They may also have established relationships with C-level executives which could prove invaluable when trying to close deals.

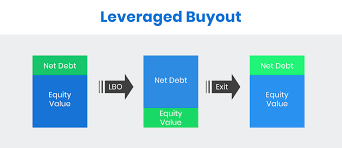

Private equity firms using a leveraged buyout involve using significant debt to acquire companies, with interest payments on this debt being tax-deductible and increasing expected returns while simultaneously increasing risk that if times get tough for any reason whatsoever, their company won’t be able to repay its obligations.