Private equity firms generally take over companies

When it comes to investing, there are various paths available. Stocks, mutual funds, real estate and other asset classes may all be viable choices; but

private equity may be something many investors overlook.

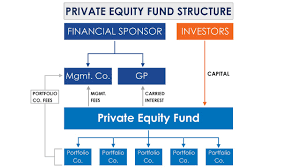

Private equity investment refers to investing in privately held companies with an eye towards value creation. It typically involves taking a minority stake in the target company and making significant changes such as restructuring or increasing sales and profits. Private equity can offer significantly higher returns than their public market counterparts due to being less volatile.

Private equity firms‘ enormous returns often draw both admiration and envy, often being attributed to aggressive use of debt, cash-flow focus and freedom from public company regulations, plus generous operating manager incentives. Yet these factors alone cannot account for PE’s success – their primary strategy of “buy to sell” remains rarely employed by public companies which generally acquire assets in order to keep them.

Some analysts compare the cycle of private equity investment – acquire, restructure, resell – to house flipping: purchasing homes, making improvements, and then selling them back on for a profit. But unlike house flippers who only need to consider short-term value when selling again later on, private equity investors must take into account long-term stability when considering future buyers for their investments.

Private equity firms generally take over companies with a plan in mind to increase the valuation. This may involve drastic cost cutting measures or restructuring steps that were resisted by incumbent management, since private equity owners only have so much time before selling off the company for profit.

Private equity firms usually have access to strategic and financial buyers that provide lucrative exit options when the time comes for selling, which can be particularly advantageous for entrepreneurs or business owners who have a passion for their venture but need to expand operations by scaling up or diversifying operations.

An investment in private equity is vital as it can diversify and protect you against some of the risks of publicly traded stock markets, including economic slowdowns, political unrest, rising interest rates, natural disasters and health crises. Due to its low correlation with public markets, private equity can help stabilize returns and keep profits flowing during these market conditions.

When investing in private equity, we strongly suggest conducting extensive research before committing any capital. It may also be wise to speak with one of Moonfare’s investment experts who can offer exclusive research insights and more information on the industry. To get started today, simply create your free Moonfare account now.