Private Equity Firm Agreed to Sell Majority Share in Grant Thornton

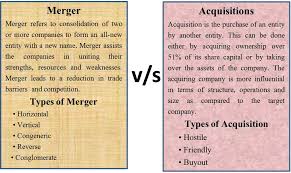

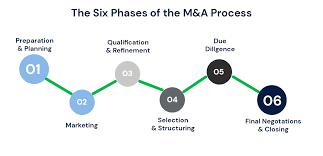

Private Equity (PE) firms employ many creative tactics when structuring mergers and acquisitions deals designed to entice you to sell your

business, including various structural elements that can have a major impact on both the purchase price you will walk away with and post-closing rights and obligations. Therefore, when making this decision it is crucial that you are as informed as possible; consult peers within your industry, high-end professional networks such as YPO or Tiger21 membership networks as well as M&A advisory firms when possible – make sure that several PE firms speak directly so you have more perspectives when choosing your perfect partner!

Relationships between PE partners are of the utmost importance in any transaction. While it can sometimes become tenuous during a transaction, there are steps you can take to minimize this risk – the key being choosing a firm you can rely upon during both good times and challenging ones.

Recent years have witnessed an upsurge in accounting and consulting partnerships responding to private equity offers from investors, due to a desire to accelerate growth, create more appealing incentive structures for partners and staff, and receive a lump sum at closing. Hellman & Friedman bought majority ownership in Baker Tilly US last month while TowerBrook Capital Partners invested in EisnerAmper in 2021; New Mountain Capital now plans on purchasing majority ownership at Grant Thornton (one of the 25 US accounting and consulting firms).

New Mountain’s approach has always emphasized non-cyclical growth and business building for companies in selected “defensive growth” industries, developing expertise through deep fundamental research to distinguish themselves with unique sourcing capabilities and value creation capabilities. Since inception, New Mountain has helped generate over $85 billion of enterprise value gains in portfolio company sales without experiencing a single private equity bankruptcy or missed interest payment.

The Firm invested more than $15.4 billion into New Mountain Partners VII, L.P. and related vehicles since it closed on July 1, 2024. Fund VII included approximately 400 investors such as pension funds, insurance companies, sovereign wealth funds, asset managers, foundations, endowments, family offices, RIAs, and high net worth individuals.

Information provided in this document comes from sources we consider reliable; however, we make no warranty as to its accuracy or completeness. Nothing herein should be seen as an offer to sell or solicitation to buy any securities managed by the Partnership or its affiliates, as such transactions require an official private placement memorandum describing terms and risks for an investment decision. This document is solely meant for distribution among sophisticated persons meeting qualifications imposed by federal securities laws to receive such information.