Private Equity Buys Majority Stake in US Accounting Firm Baker Tilly

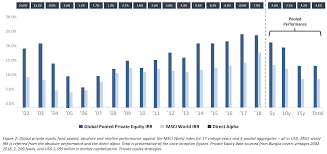

Private equity is an investment type in which investors purchase shares in a company and attempt to improve it by increasing revenue,

decreasing costs or growing its business overall. Once this work has been done, private equity firms usually sell off those shares at a profit and typically offer them back up for sale again later – although it’s hard to determine exactly how much a firm makes each year due to all of their different investments across diverse industries.

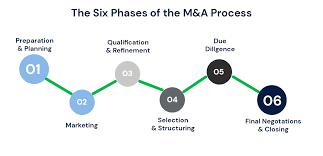

Top-10 accounting firm Baker Tilly will receive a substantial cash infusion from private-equity investors, becoming the second major deal involving a top 10 firm this year and fifth such deal since 2016. According to Reuters, Hellman & Friedman and Valeas Capital Partners will take an ownership stake equal to approximately half its total value and become major owners in Baker Tilly.

Baker Tilly now boasts an enterprise value of more than $2 billion and will have sufficient capital to pursue what CEO Jeff Ferro describes as an aggressive acquisition strategy. Additionally, the company will be split into two entities with Baker Tilly Advisory Group LP providing advisory, tax and other services with Ferro continuing as CEO; Baker Tilly US LLP remaining focused on audit and attest services.

Baker Tilly is one of the premier CPA and consulting firms in the United States, known for their client-centric approach and complex problem solving. Baker Tilly offers strong support to employees and interns alike and runs an intensive internship program for college juniors which provides access to formal training, on-the-job learning opportunities and mentoring from senior team members. Furthermore, they prioritize diversity and inclusion initiatives, offering internal mobility options to employees as part of its Diversity & Inclusion initiative.

Baker Tilly recently assisted an investment firm with meeting industry reporting standards by working on both their audit and tax needs. Baker Tilly proved responsive and was well integrated with other accountants the firm worked with to produce consistent results.

One way that private-equity firms can add value to the companies in which they invest is by improving efficiency and reducing waste, providing expertise in specific areas like regulatory compliance, operational risk management and tax efficiencies.

An investment firm with extensive industry knowledge, an expansive network of contacts and an expansive pool of professionals can be an invaluable partner to accounting and consultancy firms seeking to expand their reach or increase profitability. Such firms’ expertise can save clients both time and money when it comes to navigating changing regulations or complex corporate structures; moreover, it may help identify areas of duplication or redundancy within a firm for greater cost efficiency.