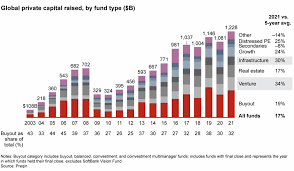

Private Capital Markets Have Been Outperforming Equities

Private capital markets remain popular despite numerous challenges to their investments – and it is for good reason. They provide growth

and resilience – both desirable traits in volatile times – while offering diversification options that are less correlated with public assets.

As of June 30th 2023, private market investments totaled an estimated US$24.4 trillion – and are expected to continue growing due to various tailwinds such as family offices, high net-worth individuals (HNWIs), intergenerational wealth transfer, and companies staying private longer. Private investments remain an integral component of global economies with over US$3 trillion estimated outstanding corporate debt outstanding and growing pools of dry powder ready for investment (such as private equity, venture capital or private credit).

Private markets provide greater potential returns than their public counterparts due to being less correlated with traditional asset classes and providing diversification by giving exposure to real economy assets. Furthermore, investing in private assets tends to be more liquid than publically listed ones and can even serve as a hedge against inflation.

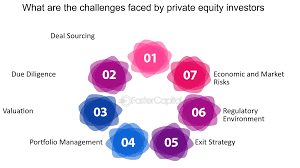

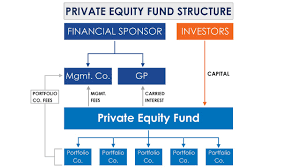

However, accessing these investments remains challenging for retail investors, particularly retail ones. Private market investing is only open to qualified investors who meet certain criteria such as accreditation. Furthermore, most opportunities – be they funds, co-investments or direct investments into private companies – require extensive due diligence on behalf of the investor largely because many investments are structured as closed-end funds with only limited redemption periods (for instance business development companies in the United States).

While selecting and selecting an opportunity is crucial, it is equally essential to think through how its allocation will fit within your broader portfolio. To do this effectively, investors must carefully assess their risk-return appetite, liquidity needs and cash flow needs when making their allocation decisions. It is also necessary to understand how private markets will fit into strategic allocation frameworks including how alternative investments such as hedge funds or cryptocurrencies fit within them.

Though private market investing has experienced difficulties this year, the outlook for 2024 remains positive. New funding sources such as private credit and crowd-funding platforms may help enhance liquidity in the sector, while inflation levels should decline gradually and support asset values thereby supporting performance of private markets. Furthermore, it is expected that managers of private markets will focus more heavily on revenue growth and margin expansion for their business models, given that most asset classes in 2023 did not perform particularly well.