Private Capital Markets – Growth and Challenges

Private capital markets have experienced tremendous expansion over the past decade, with assets under management surpassing $14.5

trillion. While traditionally restricted to pension funds, endowments, sovereign wealth funds and other large institutional investors, technology and regulatory changes are allowing access to retail savings accounts as well. Individuals increasingly focusing on income-generating strategies like private credit and infrastructure as these tend to be less volatile than stock market returns and provide stability during turbulent periods.

This growth can be attributed to several factors, including investors seeking yield, increasing numbers of HNWIs with investable wealth and the largest intergenerational transfer in history. Yet despite rapid expansion of private markets, it’s essential to remember that they should not simply serve as an alternative for public equity. Established private companies often choose to stay private longer as an effective means of controlling risk while improving returns and ensuring long-term sustainability.

Alternative Asset Management (AAM) firms have also played a vital role in expanding private markets. Over time, AAM firms have extended beyond traditional private equity and venture capital practices into newer niches like private debt, infrastructure and real estate investment; expanding investor access while increasing returns in these sectors.

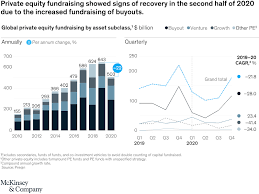

However, this market does not come without its challenges. First and foremost is an oversupply of capital; fundraising remains intense as evidenced by an increase in dry powder (capital committed but yet deployed) during 2023; average deal multiples also decreased from their historical highs due to weakening demand and higher financing costs.

Higher rates have had a detrimental impact on leveraged loan transactions and can even push them into negative territory (see Figure 12). At the same time, LBOs are becoming harder to carry out due to reduced valuations for target companies and limited assets that make for attractive acquisition opportunities (see Figure 14).

An additional major challenge has been the shift in ownership dynamics. While corporate acquisitions have remained robust, private equity-backed company deals have decreased and thus more deals involving private credit or income-generating strategies have taken place as interest rates recover.

Last, sponsorship-to-sponsor channel (deals between PE firms) has become more difficult due to rising interest rates. Transaction values dropped 47% versus 2022 with unbridgeable spreads between bid and ask making transactions unviable.

Even amid these obstacles, the industry remains on track for further expansion in coming years. A variety of factors contribute to this optimism; including strong investor returns across all private market segments, an increase in HNWIs with investable wealth and record low unemployment rates. But to maintain its growth momentum, industry members will need to increase efforts across several areas.