PE fund’s lifecycle

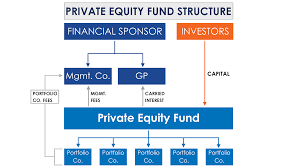

Private equity funds are pools of money used to purchase and then restructure companies with the purpose of turning a profit. They typically receive

funding from large institutional investors such as pension funds, sovereign wealth funds and endowments as well as high-net-worth individuals. Private equity firms manage these funds, taking a significant stake in each company they buy (often controlling ownership position), before conducting due diligence to find ways to improve value (reducing costs, restructuring operations or growing revenues), multiple arbitrage (buying shares trading below intrinsic values) or multiple arbitrage (buying shares which trade below their intrinsic values).

PE firms also invest in companies with innovative business strategies that may be too risky for conventional public investors, providing valuable expertise and experience to their portfolio companies. PE firms may help implement ESG frameworks, reduce expenses or enhance technology to give their portfolio companies an edge; negotiate favorable terms with suppliers/customers as well as improve company governance practices.

However, these strategies don’t come without risk. PE firms sometimes add significant debt to the companies they purchase in order to boost returns for investors; this can have disastrous results should business conditions deteriorate quickly. Therefore it is vitally important that due diligence procedures be conducted thoroughly to ensure that PE firms are being honest with their investors.

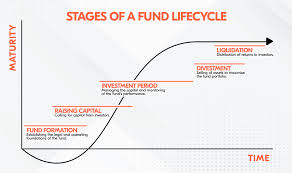

As with any investment, it is wise to diversify your portfolio with multiple assets. While mutual and exchange-traded funds can often be bought and sold regularly, private equity investments tend to be illiquid; investors cannot sell their stakes until after the fund’s term has ended (which could take anywhere between ten years and 15). Furthermore, minimum investment requirements often exist with these private equity funds.

Long-term investments and their inaccessible nature have historically limited investors’ control of their portfolios; however, the growth of secondary markets for private equity stakes has allowed for greater liquidity and flexibility for those wanting to rebalance or access cash quickly.

As with any investment, it is crucial to carefully consider the fees and expenses associated with private equity (PE) investing. As per SEC enforcement actions against funds and investors for failing to adequately disclose fees incurred over a PE fund’s lifecycle. Such expenses typically include management fees – typically a percentage of total assets held – and carry fees, which represent the General Partner’s share of profits above a predefined performance threshold; both can add up quickly over time.