Mergers or acquisitions provide many other advantages

Acquiring another business is one of the fastest ways to expand your company and accelerate growth. Mergers or acquisitions provide many other

advantages as well, including expanding customer bases, accessing new markets, and strengthening product lines. Preparation for such transactions, however, can be complicated; you should ensure an extensive information gathering process to avoid overpaying as well as finding experienced leadership/advisors who look out for your interests during negotiations.

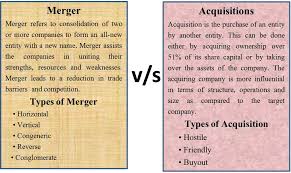

General merger and acquisition transactions generally involve merging two companies into one entity through consolidation or other means, with consolidation being the most prevalent type. Under consolidation, an acquiring company assumes all assets and liabilities from their target, while with statutory mergers becoming sole owner and ceasing to exist independently of them; subsidiary mergers permit their target to continue operations as usual while still remaining separate legal entities from their parent.

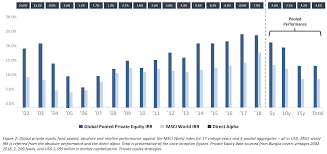

M&A activity can be driven by numerous motives, including growth, market power, acquisition of unique capabilities and resources, diversification, management incentives, tax considerations and discovering hidden value. Navigating this complex process may prove to be daunting for small-to-midsize businesses without internal expertise in M&A transactions.

At the outset of an M&A transaction, a high-level evaluation is undertaken of the target company to ascertain if there is strategic alignment and values alignment between both entities. Following this evaluation process, parties begin negotiations to agree upon terms for sale which could involve cash, stock or assumption of debt as considerations of financing options available and their effects on the transaction are carefully examined.

In the third merger wave (1965-1989), corporate marriages often involved firms from different industries to diversify and smooth out cyclical bumps in the economy. Today’s merger-and-acquisition activity, on the other hand, tends to favor companies within similar industries for acquisition.

Decidence on M&A transactions often comes down to cost and how it would improve an acquiring company’s own business, so it is crucial that all possible financing options and financial advisors be considered during negotiations. Furthermore, understanding an acquiree’s data and its effect on acceleration of revenues, customer outcomes and optimization of demand generation marketing dollars are equally important factors.