M&A transactions can be extremely advantageous

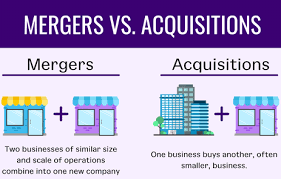

M&A (mergers and acquisitions) is a form of growth strategy used by businesses to access new markets, strengthen market positions and accelerate

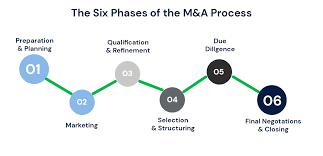

growth rates. These goals can be accomplished either through buying out competitors or entering strategic partnerships with other businesses. To begin M&A activity effectively, companies need a strategy for success that details what you hope to gain through this acquisition as well as current market conditions, financial status and projections for the future. To create such an acquisition plan. The first step should be forming an acquisition strategy outlining exactly what goals can be expected with M&A activity and then creating an Acquisition Strategy outlining what outcomes might occur as part of this activity.

M&A deals typically take the form of purchasing companies. Payment may take the form of cash, stock or some combination thereof. When buying by stock, acquiring companies typically receive shares proportional to valuation – this transaction often referred to as “takeover” rather than merger since control over a target company is acquired through this method.

Other forms of mergers and acquisitions (M&A) involve joint ventures and alliances – collaborative partnerships among two or more companies aimed at developing innovative products or entering new markets; they may also serve to increase efficiency by pooling resources, eliminating duplication of effort, and sharing costs more equitably.

Successful M&A deals require all parties involved acting in their best interests; this can sometimes prove challenging during negotiations. When conducting hostile transactions, success largely depends on how the offer is communicated to and perceived by target board of directors, employees, shareholders and others involved with the deal; whether an acquirer can secure approval through altering terms or improving offerings provided by their acquiring company.

Financial implications should always be carefully considered during an M&A transaction as this can have serious ramifications on a company’s bottom line. Overpaying can result in additional debt obligations that may hamper future growth strategies and make future acquisitions riskier and disruptive. Finance must be involved early on to avoid potentially risky or disruptive transactions from taking place.

M&A transactions can be extremely advantageous, but to reap their full potential it’s essential that you gain a solid grasp on their various types and how they support long-term business objectives. To avoid costly errors and save yourself from making costly errors it would be prudent to work with an experienced M&A advisor in structuring deals in a manner that best supports company’s growth strategy.