Investment in private equity funds can be an attractive opportunity

Private equity (PE) funds are pools of investments managed by private equity firms to acquire and hold assets, typically on behalf of investors. Due to

their illiquidity and long investment horizons, investors may face long waits before being granted access to their capital. Yet private equity firms such as Blackstone, Carlyle & KKR remain prominent contributors in mergers & acquisitions (M&A).

Private equity is an alternative asset class with returns less correlated to public markets, providing diversification benefits to any portfolio. But private equity funds also present unique risks not present in public markets; for instance, lack of liquidity, prolonged investment horizons and high fees.

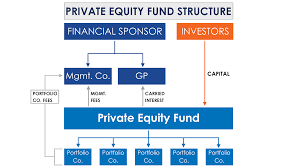

Many private equity firms are structured as limited partnerships or LLCs that pass profits and losses directly through to investors, creating significant management and carried interest fees, unrealized investment gains andphantom income; it’s therefore imperative for investors to review all fees and expenses associated with private equity investments before making their decision.

Although all private equity is designed to generate positive returns on invested capital, its strategies vary. Venture capital specializes in early-stage companies without profitable histories; growth equity provides funding to established firms looking for expansion; while leveraged buyouts involve purchasing an organization with debt to increase returns for equity investors.

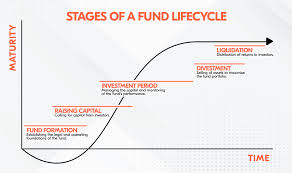

Private equity (PE) investing is typically seen as long-term endeavor, typically lasting 10-12 years on average before returning any gains to investors. PE investors understand this long term outlook, forgoing short-term market returns in favor of more substantial long-term gains.

Investors can access private equity through direct investments, exchange-traded funds or closed-end funds. Institutional investors such as pension funds and university endowments as well as high net-worth individuals typically participate in these funds; high net-worth individuals must meet accreditation requirements which usually entail earning over $200,000 annually or possessing over $1 million in net worth without considering their spouse or any possible secondary investors as investments in order to access these funds.

Investment in private equity funds can be an attractive opportunity for those with the financial resources, however their illiquidity and long-term horizon can make them unsuitable for a diversified portfolio. Therefore, investors are advised to spread their investments across a range of asset classes and sectors so as to reduce risk.