How Private Equity’s Bolt on Market Has Changed

Private equity firms traditionally look to maximize their returns by purchasing underperforming companies and injecting capital to prop them

up, followed by restructuring operations and management to increase efficiency, profitability and valuation in anticipation of an eventual sale. Advocates for this industry argue that PE firms play an essential role in economy by saving financially-strapped firms from bankruptcy while creating jobs.

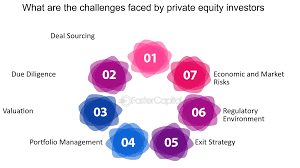

Critics of PE often highlight its effects on the economy and public markets, including on stoking volatility on public markets. Some of PE firms’ more controversial tactics include loading companies up with debt to increase valuation prior to selling them; alternatively they have tried to counter any misconception that they are simply strip miners by emphasizing management expertise and successful transformations among portfolio companies; furthermore many also emphasize environmental, social and governance (ESG) standards that guide companies in tending to stakeholders other than owners.

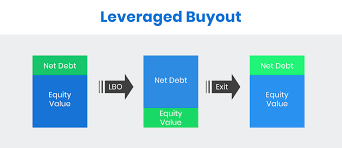

Firm A purchases a controlling stake in company B, believing that with better managers and significant changes to its business model, its growth prospects would improve. They may attempt to cut costs or sell off parts of the business before borrowing money from limited partners – in what’s known as leveraged buyout – to finance the purchase and pay for any necessary repairs – this process being known as leveraged buyout.

Once a private equity firm acquires a company, their goal is usually to increase the valuation by making dramatic cost cuts or restructuring changes that incumbent management would not agree to on their own. They might also make strategic investments such as expanding geographic footprint or entering new product lines – ultimately with the aim of attaining high risk-adjusted returns that cannot be found through public markets alone.

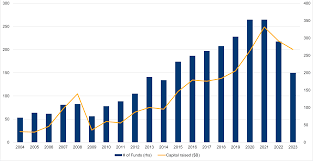

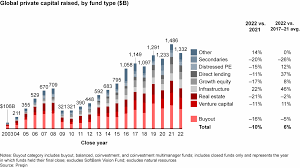

Recent years have seen an increase in interest rates that has made it increasingly challenging for private equity (PE) firms to extract value from their investments. According to Bain’s new report released today, increasing cost of financing has put pressure on PE strategies that rely on cheap leverage in order to generate returns; scarcity of affordable lending has reduced megadeals by half while decreasing average deal sizes by roughly equal amounts.

Under increasing competition for capital, PE firms have turned to secondary funds as an alternative source of cash flows from traditional income sources. One such fund was set up specifically to assist both GPs and LPs sell or restructure PE-backed companies for liquidity purposes – these funds raised more than double what they did last year with an even smaller base! Nonetheless, growth of the industry as a whole remains stagnant, prompting many LPs to reconsider their allocations and strategies within PEs.