How Private Equity Fund Managers in USA Have Adapted to Higher Interest Rates

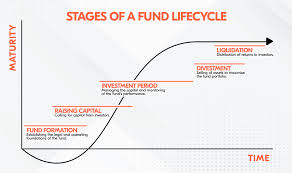

Private Equity (PE) fund managers in USA focus on making money for their investors through profit generation. Before making investments,

PE fund managers perform extensive due diligence research on both companies and industries before making decisions to invest. Criteria used include whether an industry is difficult for competitors to enter; producing consistent profits or becoming profitable quickly; having an effective management team; not facing significant disruption through technology or regulation changes; not overextended in debt and more. In contrast to hedge funds which typically purchase investments for up to 10 years before selling for profit later, PE firms sell when they reach their exit targets – unlike hedge funds which typically acquire and hold investments until generating returns at some later point compared with 10 year hold time.

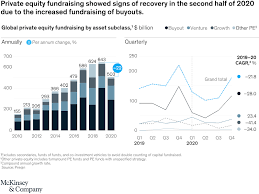

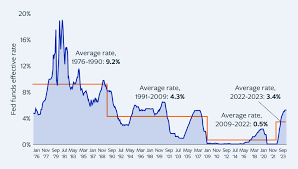

Rising interest rates have upended the private market investment landscape over the past decade by driving up debt costs and decreasing valuations in many PE buyout strategies. As a result, new funds and deals have significantly diminished.

Rising rates have caused the high-yield bond market to close, reducing loans available to private equity funds looking for acquisition opportunities. This has driven up financing costs for target companies and caused gridlock among industries trying to find buyers that can justify higher valuations.

Due to these challenges, LPs have adjusted their risk appetites and expectations than they had over the last decade. This shift has made manager selection even more critical; helping distinguish GPs who truly create value over those who ride an advantageous economic environment.

Private equity fund managers have increasingly turned to secondary purchases as a strategy for mitigating rising interest rates, offering their stake in portfolio companies for sale or sale of another investor at minimal return capital cost and while also minimizing conflicts of interest with current investors.

Private equity fund managers have recognized this shift and are developing more “operationally focused” value creation strategies to boost portfolio companies’ profitability. These may involve simplifying business structures, rationalizing balance sheets and cutting costs to increase cash flow; or revamping product offerings or brands so as to boost revenues while competing against online competitors – these changes being especially crucial in today’s landscape of multiple compression and increased cost of capital.