How Mergers and Acquisitions Are Done Correctly

How Mergers and Acquisitions Are Done Correctly

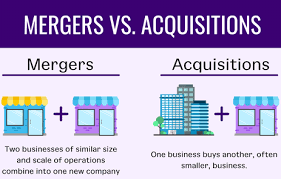

“Two heads are better than one,” is an old saying, and this certainly applies to mergers and acquisitions (M&A). By joining forces, businesses can

create value they couldn’t otherwise create on their own – yet success of an M&A deal requires careful coordination among all the people involved, particularly regarding its structure changes and employee management issues.

M&A transactions often take months or years to complete, disrupting productivity at your company and pulling away valuable team members from their usual roles and responsibilities. A robust due diligence process can help minimize these effects so your team can focus on M&A work without worrying about its effect on day-to-day operations.

M&A activities may be undertaken for various reasons, the primary one being revenue synergies derived from buying out competitors and sharing resources such as sales, marketing, distribution or accounting systems. Another motivation might be diversification; companies often acquire other firms in order to reduce cyclical fluctuations within their business or expand into new geographic markets more easily.

As well as increasing revenue and market power through M&A deals, companies may use M&A deals to enhance their access to technology and expand unique capabilities. Examples could include purchasing supplier technologies to take advantage of economies of scale — where production increases bring lower unit costs per unit — or developing and introducing products faster than competition. Other motivations might be management personal incentives, tax considerations or discovering hidden value in a target company.

A company making an acquisition may acquire both its assets and liabilities of its target firm, or just those related to environmental damage, employee benefits, or product liability. With the latter option, an acquiring firm can cherry-pick specific assets without incurring liability related to environmental degradation, employee benefits or product liability issues.

As with any corporate transaction, M&A deals can be complex affairs with serious potential for financial losses – in extreme cases even leading to bankruptcy. To minimize risks during and post-deal closure it is essential that M&A teams be well prepared for various potential issues which could arise before, during and after deal closing; such preparation starts with having a solid plan in place as well as gathering relevant data that reveals true risks and rewards of an M&A deal.