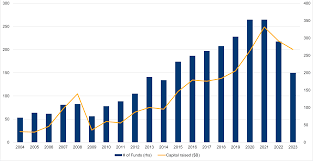

Growth in Private Markets Has Proved Consistently Stronger Than in Public Markets in Recent Years

Recently, growth in private markets has consistently outshone that of public markets, in part due to investors being more willing to forego

liquidity in exchange for an attractive premium. Private markets also boast more diverse investment options compared with public ones allowing investors to more easily achieve desired investment outcomes across a total portfolio context.

However, despite their increased awareness of private markets, many investors remain under-exposed to them. We believe this to be an error since by not participating in private markets investors miss out on potential higher growth companies and disruptive technology that might offer higher returns as well as losing out on any opportunity that might present itself in terms of exposure or returns.

Underestimation can be explained by several factors. First, private markets lack a similar regulatory structure as public ones and therefore, are difficult to accurately measure their performance. Furthermore, tracking funding to investments through them is like trying to navigate a maze with no visibility whatsoever.

Private market investments typically consist of closed-end funds with long-term commitments that limit liquidity transformation and protect fund managers from short-term pressures, making these funds especially useful when investing in innovative start-ups or mature firms in need of restructuring. Furthermore, their limited liquidity mismatches help mitigate monetary policy transmission issues.

But we believe investors should increase their allocations to private markets for several reasons:

As private markets provide key environmental, social and governance benefits, they continue to demonstrate their worth from an environmental, social and governance viewpoint. By serving as an essential source of financing for innovative and scalable business models that support economic development and providing niche middle market businesses access not usually provided by traditional lenders – these markets continue to play a critical role.

As such, we have increased our focus on private markets by creating a committee within the Investment Association to address their unique challenges and opportunities. Its work includes exploring how to expand investor access to long-term and illiquid assets (such as private markets), support its growth by increasing awareness, and promote its role in an investor’s total portfolio.

Though we are pleased by the increased representation of women and ethnic and racial minorities at private markets firms, full equality still eludes them. Entry-level female representation lags behind corporate America while senior levels even further away; therefore McKinsey’s 2023 State of Diversity in Private Markets report predicts it may take several decades until gender parity at private market investment firms is achieved.