Buyout Firms Adjust to Higher Rates While Other Hurdles Loom

Private equity firms hold substantial funds on their balance sheets, yet are struggling to turn that capital into returns as rates increase and

macro uncertainty hampers business activity.

The key challenge facing leveraged buyout financing will be returning to lending standards predating 2008 Financial Crisis.

Interest coverage ratios slipped below 2.0x EBITDA last year for the first time since 2007. This has required general partners (GPs) to find ways to boost returns in their portfolio companies while finding sources of liquidity to pay down debt when due.

At least for now, it seems the days of large leveraged buyouts may be behind us. Last year’s figures indicate a decline in LBO activity as deal sizes dropped significantly due to difficulty finding affordable borrowing terms and rising interest rates/credit concerns limiting activities of larger funds managed by LPs.

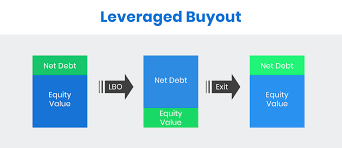

LBOs typically involve financing from both debt and equity sources, with debt usually provided by limited partners (LPs), as well as some in-house resources or funds within the firm itself, and mezzanine funding usually coming from banks or private lenders; mezzanine loans often tie to the underlying business with some also coming with rights to participate in its future equity offerings.

In 2023, mezzanine loans only comprised 22% by value and 31% by volume of LBO transactions, far lower than their peak when market size peaked at $80 billion in 2006 due to leveraged buyouts.

Sponsor-to-sponsor deals were an especially disappointing exit channel in 2023; their value declined 47% compared to 2022.

As rates remain stagnant, it will be challenging for the buyout industry to make any progress against its $3.2 trillion of unliquidated assets, especially since many are four years or older. That will place an enormous burden on GPs to find ways to increase dividends while also making an impactful dent in long-term debt overhang by selling off some of their older portfolio companies. Otherwise, investors could face an unstable ride through the investment industry. Investors will closely observe LBO activity before making any adjustments to their allocations or viewing any GP track records for indications that they can deliver on promises made. We think the industry is beginning to show some signs of life, though its journey remains bumpy for some time yet.