R1 RCM to Go Private in Deal With TowerBrook CD&R

R1 RCM to Go Private Through Partnership with TowerBrook CD&R Healthcare services provider R1 RCM Inc. has agreed to be acquired in

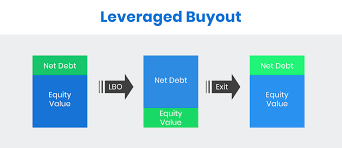

an all-cash deal valued at $8.9 billion from investment funds affiliated with TowerBrook Capital Partners and Clayton Dubilier & Rice for $890 Million all cash deal valued at approximately $890 Million by investment funds affiliated with those firms. This sale underscores private equity’s continued appetite for “revenue cycle management” companies specializing in billing, collections and patient registration for hospitals while Utah-based RCM provides solutions designed to improve financial performance, increase revenue yield and reduce operating costs within health systems/hospitals alike.

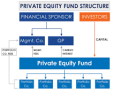

The transaction is expected to close by year-end, subject to customary closing conditions such as stockholder approval and regulatory approvals. Financing for this acquisition will include both committed debt financing and equity from buyer investment funds, with Centerview Partners LLC serving as lead financial advisor and Wachtell, Lipton Rosen & Katz and Debevoise & Plimpton LLP acting as legal counsel to each entity involved in this deal.

Kirkland & Ellis advised R1 RCM on their deal, led by corporate partners Robert Hayward and Sarkis Jebejian as well as capital markets partners Brad Reed and Steven Choi from its Capital Markets Practice Group. Additionally, associates Jill Bates and Amy Fang provided transactional assistance while the firm provided its global finance, real estate, intellectual property and technology practices as support.

NOTE: Please be aware that in connection with its proposed transaction, the Company will file with the SEC both a proxy statement on Schedule 14A and transaction statement on Schedule 13E-3 in their definitive forms, which will then be provided or sent out to stockholders of the Company. Furthermore, its directors, executive officers and certain other employees may be considered participants in soliciting proxies from stockholders in respect of its proposed transaction. For more information on who might participate in solicitation activities related to solicitation activities please refer to definitive proxy statement/transaction statement/materials filed with SEC by Company in advance of transaction//prospective.