WPP to Sell Majority Stake in PR Firm FGS to KKR for $775 Million

WPP to Sell Majority Stake in PR Firm FGS to Kohlberg Kravis Roberts for $775 Million

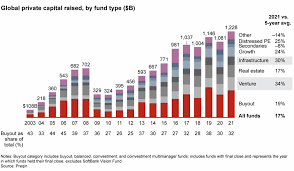

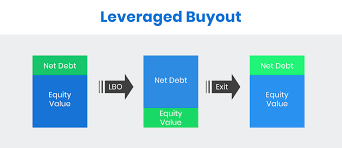

In an initiative that may put off FGS’ planned public offering, advertising giant WPP has agreed to sell its majority stake to private equity firm Kohlberg Kravis Roberts (KKR) for around $1.7 billion, marking yet another buyout boom by large investors such as KKR and EQT that ventures into communications advisory businesses once considered niche or distressed investments.

FGS is a global financial PR and government affairs firm with offices in 30 cities around the globe and more than 1,400 employees. Established in 2021 through a merger of D.C.-based consultancy The Glover Park Group, U.K.-based Finsbury, and German Hering Schuppener and Sard Verbinnen & Co, FGS offers clients advice regarding corporate positioning, crisis management, government affairs as well as other topics.

WPP released a statement explaining its sale of FGS shares as part of an initiative to improve financial performance and reduce debt. WPP plans on using proceeds from this transaction to reduce net debt by three thirds by 2020 and boost free cash flow, in addition to investing in its world-class creative, media, corporate public relations, consumer public relations businesses in order to drive future growth.

WPP announced its inaugural major deal since Philip Jansen became its new chairman last week, in order to boost financial performance and reevaluate strategy amid increased competition from other consultancies. Additionally, this move may cause delays to an expected public listing of FGS business within two years.

KKR, already an investor in FGS, is a prominent global private equity firm and represents one of its oldest deals. Their investment shows the growing need for communications advice among clients concerned about corporate reputational risks, regulatory oversight and geopolitical tensions.

WPP plans to complete its acquisition of FGS by year’s end through a buyout transaction structured as a buyout of its remaining stake held by WPP with FGS partners and management holding a minority interest. Goldman Sachs International will act as financial adviser on this transaction.

WPP announced its decision to sell its stake in FGS after experiencing an underwhelming second quarter that saw all main agencies experience revenue declines (with the exception of CPG and technology clients), full-year organic growth projections decreased from 1.8% to flat at best and shares dropped 1.2% early Wednesday trading. WPP owns Ogilvy & GroupM advertising agencies as well. –By Mark Kelly/MarketWatch