Public Market Volatility Rake Bigger Concerns For Private Equity Firms

Recent volatility in public markets is posing serious threats to private equity (PE) firms. As they adjust to these new market realities, many

smaller PE firms are turning towards mergers or acquisitions as a means of survival. This consolidation trend stems from increased regulatory costs and competition which makes attracting funds from large institutions harder for PE firms, leaving limited options for growth. Furthermore, an overcrowded PE landscape makes competing more challenging in an ever more complex and competitive environment.

At present, the PE industry is consolidating rapidly. Smaller firms may find it easier to merge with larger entities with greater resources and networks that can strengthen their offerings and broaden client bases – this trend especially evident for firms experiencing increased compliance costs or experiencing regulatory scrutiny that make raising capital difficult.

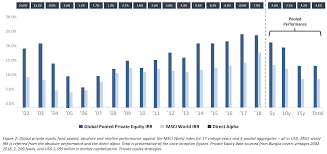

When markets experience volatility, limited partners (LPs) tend to invest less in PE deals resulting in decreased fundraising and an uptick in secondary deal activity. This has created an opportunity for general partners (GPs), particularly with retail investors and quasi-retail LPs becoming active again. PE firms have taken advantage of this trend by developing platforms and financial products specifically targeted towards retail investors as well as white-glove services like tailored portfolio management and valuation to reach this investor class.

Public market volatility can have a significant effect on the valuations of private company investments. Advisors frequently rely on publicly traded market inputs when conducting their fair value calculations; during times of high market volatility, prices of these inputs may experience extreme and frequent price swings, leading to material mark-ups or mark-downs that make valuation more challenging – particularly during year-end audits when large swings in fair value may prove hard to explain.

Experienced general partners (GPs) have learned to adapt to market dislocations, understanding the importance of maintaining momentum and seeking out quality deals in challenging conditions. While current market environments present unique opportunities, including potential downturns that provide opportunities for building long-term investor relationships for future markets. Key to success for experienced GPs lies in not letting fear paralyze them but instead dusting off their market dislocation playbooks in preparation for when economic cycles turn back up again.