Mergers & Acquisitions can help companies grow and compete.

Mergers & Acquisitions (M&As) can help companies grow and compete. Two heads are better than one, as the saying goes – and businesses can realize

significant synergies when merging or acquiring other firms. While M&A processes may seem lengthy and involved, with numerous moving parts; for instance, M&A lawyers provide legal analysis as part of the negotiation process as well as helping facilitate negotiations and finalize contracts; these professionals work in various industries such as finance, technology and health care.

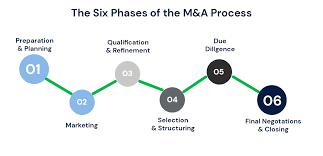

M&A transactions often start with high-level discussions between company executives to assess whether two businesses have strategic synergies that might result in mergers or acquisitions, and to evaluate how best they might combine their operations. This may include studying market, financial reports and assets of a target company. A potential buyer might wish to acquire all or a controlling share in the target business and finance the deal either with cash, debt or a combination thereof; sometimes companies pursuing M&A deals may hire investment bankers for guidance during this process and advice throughout this transaction process.

Once an M&A deal is inked between an acquiring company and the target business, the latter must evaluate its value using multiple metrics – price-to-earnings ratios or discounted cash flow (DCF), for instance – to give an objective valuation. These methods allow for accurate calculation of future profits and cash flows which contributes directly to valuation.

If the target company is publicly traded, its value can be determined based on its market capitalization – the number of shares owned by investors – as well as other metrics such as earnings per share, profit margin and return on equity. An objective valuation for privately held firms can be achieved by comparing them against similar businesses within their industry or line of work.

Negotiations is the next step, which may take months or years to complete. Attornies for both companies that will acquire and target companies review deal terms, identify any risks or rewards and negotiate contracts – often consulting M&A consultants, investment bankers and law firm representatives for additional financial and legal advice.

M&A attorneys often must collaborate with outside auditors and accountants in preparing documents necessary for legal compliance with government regulations and meet with target company management to discuss any ramifications from any potential deals.

After an M&A deal has been successfully executed, HR must be ready for any cultural adjustments and redundancies resulting from merging companies. Therefore it’s crucial that HR departments begin planning for M&A transactions well in advance of due diligence and board voting on formalizing them formally; this also serves as an ideal time to review HR policies and update them according to best practices.