Private equity firms face unique challenges when purchasing

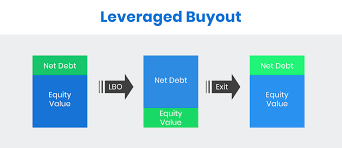

Private equity firms’ remarkable returns often draw admiration and envy. Such impressive results may be attributable to aggressive use of debt, focus

on cash flow and margins, freedom from public company regulations, or lavish management incentives.

However, these strategies do have drawbacks and in many instances, don’t result in favorable conditions for other stakeholders such as employees, consumers and communities that depend on businesses. ProPublica recently highlighted an example wherein a hospital chain run by a private equity firm managed to generate $14 billion for investors while nurses could no longer afford basic supplies like sponges and IV fluids, while ambulance drivers’ fuel cards kept getting rejected at the pump.

Critics also note that private equity-owned companies are saddled with so much debt they are unable to invest in themselves, an essential aspect of driving growth and expanding market share. Some of these businesses struggle against changing consumer tastes and intense competition – iconic retail brands such as Payless, Sears, and Toys “R” Us all experienced difficulties recently.

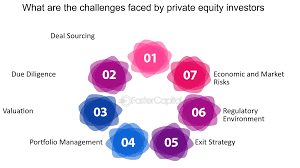

Private equity firms face unique challenges when purchasing and overseeing companies they invest in, which requires more than simply financial gain as the sole measure for success. A winning investment strategy involves strategic vision, operational expertise and long-term commitment; additionally, investors must remain aware of industry trends to recognize transformative impacts through well-executed deals across sectors.

Blue Buffalo Pet Foods’ story illustrates the potential success of private equity deals as evidenced by its transformation. Private equity firms provide powerful evidence for driving business transformation and creating lasting legacy benefits through business transformation efforts like this one.

As part of this episode, we talked with Shane Slominski from Tonka Bay Private Equity Partners in the Twin Cities to gain more insight into what makes successful private equity partnerships, how to identify meaningful impactful opportunities, and more. Shane has 18 years of experience working within PE/M&A space as well as spending some time as CPA in M&A industry.

Shane shared with us some insights into the significance and use of Equity Stories during sales processes. An Equity Story is a document which details an initial challenge a portfolio company faced and how this was successfully overcome through strategic investments and operational improvements; its creation should occur alongside any prospective buyers for maximum credibility and transparency.

Private equity funds should include an ‘Impact Statement’ document in their sales materials to enable potential buyers to gain a clear understanding of a business’s resilience in dealing with challenging conditions and adapt to changing environments. The document should be made easily digestible via web page, blog post, downloadable PDF or video presentation and allow quick scanning by investors when assessing its strength.