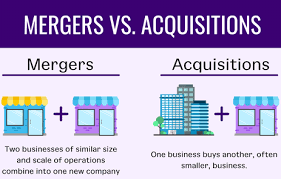

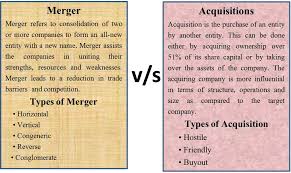

Mergers and Acquisitions can be achieved through consolidation

Mergers and Acquisitions can help businesses to expand quickly while expanding customer reach quickly. Organic growth only extends so far; at that

point, it may be necessary to merge with another company in order to increase potential growth potential and diversification of markets. Mergers can bring many advantages: economies of scale, increased revenue potential, market diversification among others.

Economies of scale occur when production costs can be decreased by producing more of a similar product, which is often the case for companies producing multiple related items. They can also be achieved through consolidation of support functions or locations and streamlining production processes in order to boost productivity and increase productivity levels. Finally, economies of scope may also be achieved through merging with another company that offers complementary products or services – for example a logistics provider which consolidates distribution centers and warehouses to increase efficiencies.

Growing a business takes more than money; it requires resources like distribution channels, equipment, machinery and staff. Therefore, merging or purchasing an already established company that already possesses such things is often faster and cost-effective than starting from scratch; this is particularly applicable when expanding into new markets since expansion typically necessitates significant capital investments in machinery and distribution channels.

Similarly, large merged entities can utilize their size and power in dealings with suppliers to negotiate more favorable pricing terms and other terms that will benefit the bottom line. They may also take advantage of bulk buying practices to lower operational costs.

An expanded company also benefits from greater negotiating leverage when dealing with customers, which can translate to improved contract terms and pricing structures as well as greater market share thanks to offering customers greater value and an exceptional experience over smaller competitors.

Buyers pursue M&A deals as another strategy to gain market dominance by purchasing businesses with strong reputations in their chosen markets. Dominance helps set industry standards, increase customer loyalty, and build brand image while protecting against volatile markets as it diversifies revenue streams from different sectors and expands their market share.