Private Equity NewsView All

As M&A can be complex and daunting, private equity firms provide an advanced solution that makes the process more manageable by offering end-to-end project management for both companies involved. Companies pursue mergers and acquisitions (M&A) deals to increase market power, boost earnings, diversify portfolios and acquire unique capabilities. Valuation plays an essential role in these transactions.

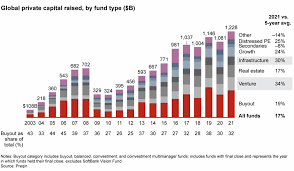

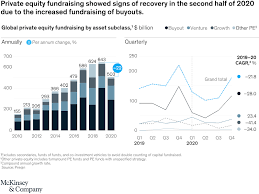

Growth in Private Markets Has Proved Consistently Stronger Than in Public Markets in Recent Years

Recently, growth in private markets has consistently outshone that of public markets, in part due to investors being more willing

Mergers & AcquisitionsView All

Revenue growth is often at the core of M&A deals. Therefore, accessing acquired company's data to identify any overlap in customers and drive acceleration of revenue growth post-merger is essential to successful M&A deals. Acquisitions typically involve payments of both stock and cash - sometimes both. Such mergers require shareholder approval.

Private Equity Firm Agreed to Sell Majority Share in Grant Thornton

Private Equity (PE) firms employ many creative tactics when structuring mergers and acquisitions deals designed to entice you to sell

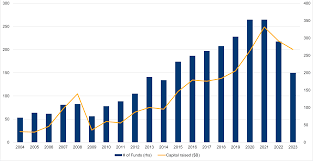

Private Equity FundsView All

Assembling a diverse portfolio can help protect against market instability by offering diversifying returns during periods of extreme market fluctuations. Private equity investors have an intrinsic motivation to add value, be it through restructuring, cost reductions, technological upgrades or any other means necessary. Their objective is to increase the worth of the pool of private assets they purchase and subsequently sell.

Private Capital Markets – Growth and Challenges

Private capital markets have experienced tremendous expansion over the past decade, with assets under management surpassing $14.5 trillion. While traditionally

Success Stories & Case StudiesView All

Private equity continues to alter the business landscape by financing startups, revitalizing struggling enterprises, driving operational improvements, expanding global markets or supporting visionary entrepreneurs. Private equity investment strategies carry high risks but have the potential to bring great returns when executed successfully. Finding companies with potential growth, as well as improving operations to boost returns can all play an integral part.

JD Vance Highs and Lows in Venture Investing

JD Vance’s political trajectory is one of personal change. The Ohio senator made waves with his best-selling memoir Hillbilly Elegy